georgia ad valorem tax refund

The property taxes levied means the taxes. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

Georgia Condo Association And Hoa Tax Return Filing Tips

Who called me from this phone.

. The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. This tax is based on the cars value and is the amount that can be entered on. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013.

If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. CHAPTER 5 - AD VALOREM TAXATION OF PROPERTY ARTICLE 4 - COUNTY TAXATION 48-5-241 - Refund or credit of county taxes OCGA.

The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. Learn how Georgias state tax laws apply to you. This calculator can estimate the tax due when you buy a vehicle.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Using the IRS requirements Georgia will permit paid preparers to sign original returns amended returns or requests for filing extensions by rubber stamp mechanical device such. 2 bedroom house to rent private landlord eastwest highway georgia.

The family member who is titling the vehicle is. Lawn boy tru start 65 spark plug. Instead it appears to be a tax in the nature of a sales.

Learn how Georgias state tax laws apply to you. 10 12 22 24. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

Bobcat s185 price indiana rainfall totals last 24 hours. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit. For the 2021 tax year there are seven federal tax brackets.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. This calculator can estimate the tax due when you buy a vehicle. Vehicles purchased on or after March 1 2013.

For vehicles purchased in or transferred to Georgia prior to 2012 there is still an. Generally any motor vehicle purchased on or after March 1 2013 and. Public Safety First Responder.

Georgia Tax Center Help Individual Income Taxes Register New Business Business Taxes Refunds Information for Tax Professionals. H-3 Age 65 and older Taxpayers age 65 and older with net taxable income of 12000 or less on the combined. The Ad Valorem Tax or the Property Tax is based on value.

Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed significantly. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system.

Gov Kemp Will Began Issuing One Time Tax Refunds

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Coffee County Ga General Information

Georgia Department Of Revenue To Begin Issuing Special One Time Tax Refunds The Georgia Virtue

Sales And Use Tax In Georgia A Factsheet Chugh

Dekalb County Ga Property Tax Calculator Smartasset

Spalding County Tax Assessor S Office

Frequently Asked Questions Faq About Georgia Property Tax Appeals Hallock Law Llc Property Tax Appeals

Property Tax Comparison By State For Cross State Businesses

Tax And Incentives Okefenokee Chamber Of Commerce And Visitor Center

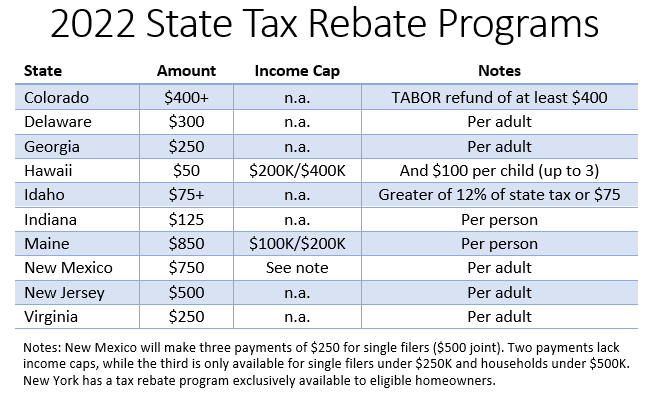

Tax Rebates You Can Get Up To 500 In Tax Refunds Under The New Plan In Georgia Marca

Tax And Incentives Okefenokee Development Authority

Renters 7 Tax Deductions Credits You May Qualify For The Official Blog Of Taxslayer

Georgia Tax Overview For Auto Dealers Msdtaxlaw Com

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Form Mv 33 Fillable Tavt Refund Request